¤¤We limit withdrawals and transfers out of your savings and money market savings accounts. If you repeatedly exceed these limits, we may close or convert your account to a checking account, which may be a non-interest-bearing checking account. 1 Chime SpotMe is an optional, no fee service that requires a single deposit of $200 or more in qualifying direct deposits to the Chime Spending Account each month.

Your limit will be displayed to you within the Chime mobile app. Your limit may change at any time, at Chime's discretion. Although there are no overdraft fees, there may be out-of-network or third party fees associated with ATM transactions. SpotMe won't cover non-debit card transactions, including ACH transfers, Pay Friends transfers, or Chime Checkbook transactions. Once you have a checking account, you can pay bills, transfer money, use an ATM and make purchases with a debit card. We offer a variety of checking accounts with options such as online and mobile banking to make it easy to bank when and where you want.

The good news is that you can still open a free online bank account with no credit check, no monthly fees, or minimum balance requirements. CheckingExpert has helped thousands of people just like you open online bank accounts. No credit check bank accounts that give you all the checking account features you need and deserve without the exorbitant fees many banks impose. Wells Fargo Clear Access Checking.The Wells Fargo Clear Access Checking Account is only offered if you are unable to open one of their regular checking accounts.

The $10 monthly fee can be avoided by maintaining a $1,500 minimum daily balance, setting up direct deposits totaling at least $500, or posting 10 or more debit card transactions each cycle. TD Bank offers two different bonuses for new checking account customers. The first is a $300 bonus for a brand new TD Beyond Checking account. New clients qualify for the bonus after making $2,500 in direct deposits within the first 60 days of opening the account.

There is no minimum deposit to open the account, but it comes with a hefty $25 monthly fee. This fee is waived if the customer maintains a $2,500 minimum daily balance. The account pays interest, and there are no charges for non-TD automated teller machine transactions. It's becoming increasingly difficult to find truly free checking accounts.

At many banks, you're now required to pay a monthly maintenance fee for the privilege of keeping your checking account open. Such fees can range from a few dollars to $20 or more, depending on the bank and other associated perks. Chime makes it easy to deposit and transfer your money with its free mobile app. You'll get access to automatic deposits, online transfers, mobile banking, and ATM withdrawals. This free checking account also comes with online bill pay, direct deposit, and a Visa debit card.

This prepaid debit card account is good for people that have bad credit and are in ChexSystems because they don't use any type of checking account reporting company. The Lili Account is a free checking account designed for freelancers, side hustlers, and solo professionals. That's a rare find in a banking industry rife with mediocrity. Our checking accounts have all the convenience your lifestyle demands. Enjoy fast, friendly service with easy access to your money. Several bank accounts have no minimums to open and no balance requirements.

We make every day checking easy with the best online and mobile options so you can pay your bills and loans online, anywhere, anytime. Until April 7, 2020, new Huntington Bank customers can qualify for one of two different bonuses after opening up a new checking account. Those who open the Asterisk-Free Checking account may receive a $150 cash bonus. There is no minimum balance requirement and this account comes with no monthly maintenance fees. For the $200 cash bonus, customers must open the Huntington 5 Interest Checking account. Banks and other financial institutions earn money from many sources.

One such source is the revenue they receive from—on-average—over 30 potential fees on checking accounts, according to The Wall Street Journal. These fees include monthly maintenance, non-sufficient funds charges, overdraft fees, paper statement charges, and dormant account fees among others. However, a cash back promotion can be a win-win for banks and consumers alike, as long as the latter remain aware of the pitfalls that could threaten their deposits.

Chime is a mobile-first banking app that merges the low cost of online checking and savings accounts with the convenience of truly on-the-go banking. The headline here is Chime's promise – subject to the policies of payers and their banks – that its Deposit Account customers get paid two days faster with direct deposit. If you're accustomed to Friday paydays but could really use the money on Wednesday, the Chime Deposit Account may be the free checking account you've been waiting for. A checking account from Capital One 360 comes with no minimum opening deposit and no monthly fees.

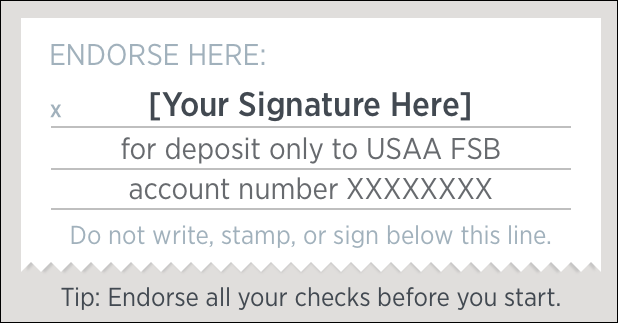

In addition, the bank offers mobile banking, mobile direct deposits, online bill pay, and access to 70,000 fee-free ATMs. To transfer money from another bank account to your IncredibleBank checking account, simply use the transfer feature in your IncredibleBank online banking or mobile app. Go to the menu, select transfer, select add an external transfer account, enter the external account information, and specify the dollar amount you would like to transfer.

More information and detailed instructions can be found on our mobile banking page. Some banks and credit unions offer so-called second chance checking accounts to help people rebuild their credit and financial histories. These accounts usually carry monthly fees and come with a few other requirements, such as participating in a financial literacy or money management class. An account holder might also not be eligible for overdraft protection, since second chance banking serves as a way to prevent overdrawing an account altogether. The researchers at CheckingExpert.com have selected the top three banks where you can get a bad credit bank account. There are no hidden fees, no minimum balance, and no monthly fees.

You can apply online and it takes only a matter of minutes to complete the application process. If you've got bad credit and need a checking account, these banks are two very strong options. You can earn up to 1% cash back on up to $3,000 worth of qualifying debit card purchases per month. The checking account doesn't come with a monthly fee, and you can pair it with a high-interest savings account. Unfortunately, discover only has one brick-and-mortar location, but they do have an extensive ATM network. Marcus offers one of the best high-interest savings accounts currently available.

The APY is 2.00%, and there is no minimum opening deposit required. There are also no monthly maintenance fees, and you can apply for a savings account online. Most online accounts come with little to no minimum balance requirements or monthly maintenance fees. Of course, you will sacrifice a certain amount of convenience, but it may be worth the trade-off to find a bank account with better terms. Instacash is a 0% APR cash advance service provided by MoneyLion.

Your available Instacash advance limit will be displayed to you in the MoneyLion mobile app and may change from time to time. Your limit will be based on your direct deposits, account transaction history, and other factors as determined by MoneyLion. You may leave an optional tip and pay an optional Turbo Fee for expedited funds delivery. For a $40 Instacash advance with a Turbo Fee of $4.99, your repayment amount will be $44.99. Generally, your scheduled repayment date will be your next direct deposit date.

An Instacash advance is a non-recourse product; you will not be eligible to request a new advance until your outstanding balance is paid. See Membership Agreement andhelp.moneylion.comfor additional terms, conditions and eligibility requirements. Suntrust Bank offers several checking accounts, all of which include online banking, mobile banking, overdraft services, direct deposit, bill pay and a SunTrust MasterCard® Check Card. Brand new HSBC customers can choose from two different checking account offers.

The first promises $475 with the opening of an HSBC Premier Checking account. In order to quality, customers must make direct deposits of at least $5,000 into the account each month for three full months from the second month that the account is open. The second offer is for up to $350 with the Advance Checking account. This bonus is earned over 12 months and requires setting up direct deposit. You'll earn 2% cash back on the amount of your direct deposit each month, up to $30 per month. This offer is good for the first 12 months of account opening and is capped at $350 for the year.

6Send Money with Zelle® is available for most personal checking and money market accounts. To use Send Money with Zelle® you must have an Online Banking profile with a U.S. address, a unique U.S. mobile phone number and an active unique e-mail address. Your eligible personal deposit account must be active and enabled for ACH transactions and Online Banking transfers. To send money for delivery that arrives typically within minutes, a TD Bank Visa® Debit Card is required. Message and data rates may apply, check with your wireless carrier. Must have a bank account in the U.S. to use Send Money with Zelle®.

Transactions typically occur in minutes when the recipient's email address or U.S. mobile number is already enrolled with Zelle. Zelle and the Zelle related marks are wholly owned by Early Warning Services, LLC and are used herein under license. The Axos Bank Rewards Checking account is one of several free checking options offered by the bank formerly known as Bank of Internet USA, an online banking pioneer. Rewards Checking doesn't automatically pay interest, but you can earn a yield of up to 1.00% on your funds by meeting certain qualifications.

These include using receiving monthly direct deposits at least $1,500. Basically, Axos Bank wants to be your primary checking account. Chime offers second chance checking and savings accounts with no monthly service fee and no minimum balance requirement. There are no physical locations, but consumers do have access to the bank's network of 60,000 ATMs across the country.

You can use Digital Banking to manage your free checking account online. Easily track your transactions, set up budgets, transfer money and make payments all in one convenient place. Download the First Citizens mobile banking app to manage your account and deposit checks on the go. GoBank's checking account is accessible online and easy to open. Avoid the monthly service fee with a $500 direct deposit.

GoBank has a large free ATM Network but cash deposits can cost up to $4.95. Online banking and bill pay is available for $4.95 per month but you don't get a debit card with this account. The US Bank Safe Debit Account has a $4.95 monthly fee. It features online banking and mobile check deposits and a Visa debit card.

However, you will not get access to paper checks with this account. Banks that offer second chance checking accounts know there may be customers with a less than perfect banking record. They are ready to help their customers work on getting back on track. However, most second chance checking accounts will have a monthly fee, some may require direct deposit and have fewer perks than a standard checking account.

Second chance bank accounts may use ChexSystems to screen new customers but offer fresh start checking accounts. These banks offer "second chance" checking accounts that give consumers an opportunity to rebuild their banking history. When a bank or credit union offers a second chance checking account, they're willing to overlook a problematic ChexSystems record. It's important to have a checking account as banks and credit unions provide safe places to keep money. Chime is a no credit check checking account with no monthly bank fees.

The Chime Spending Account is similar to a second chance checking with no opening deposit that practically anyone at least 18 years old and a US Citizen can open. Plus, if you need a credit card for bad credit, Chime will offer you a no credit check Visa credit card that reports to the three major credit bureaus if you set-up direct deposit. Receive 2.50% cash back on qualified debit card purchases up to $400.00 that post and settle to the account during the Monthly Qualification Cycle. A maximum of $10 cash back payments may be earned per Monthly Qualification Cycle. Transactions may take one or more banking days from the date the transaction was made to post to the account.

When account qualifications are not met, no earnings are earned and ATM fees will not be reimbursed. A bank account is one of those required things in life. You need access to a debit card for purchases or direct deposit from an employer. A bank account is almost the only way to enjoy these basic services. But if you've experienced financial challenges or unexpected events — and the ensuing bad credit — it may be difficult to open a new bank account. No minimum balance and no monthly service charge, all with a minimum opening deposit of only $50.

Plus, ask about overdraft protection options, such as linking your savings to your checking account5 or a checking reserve line of credit to avoid overdrafts. Discover Bank has no minimum balance requirements and boasts a pretty forgiving fee schedule with no bill pay, NSF, check reorder, replacement debit card, or bank check fees. Plus, customers have fee-free access to more than 60,000 ATMs around the U.S. – more than most competitors. All customers enjoy choice perks like discounts on certain TD Bank credit products and lightning-fast money transfers courtesy of Zelle.

Navy Federal Credit Union offers membership to active-duty or retired members of the military and their families. There are no minimum deposits, no minimum balance requirement, no monthly service fee, and free direct deposit. When most people think of Discover, they think about taking out a credit card, however, they also offer online-only savings and checking accounts. And the bank's Cashback Debit checking account is one of its best offers. In addition to online banking, they offer withdrawals at over 60,000 ATMs nationwide.

There are no monthly maintenance fees and no minimum deposit required. In addition, when you open an account, you'll get direct deposit and online transfers to and from other financial institutions. Fortunately, RoarMoney doesn't have a minimum balance for opening or maintaining the account. You also won't get charged fees if your balance drops to zero. Our bank account has no minimum deposit, no monthly maintenance fee, and you can get approved in minutes. You probably think opening an instant checking account with no deposit means you can forget about features.

That's what's so neat about a MoneyLion RoarMoney account. There's no minimum deposit requirement and only a $1 administrative fee. Additionally, MoneyLion also offers a free debit MasterCard, free bill pay service, and online banking that lets you manage your finances from anywhere in the world.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.